How Hard Money Atlanta can Save You Time, Stress, and Money.

Wiki Article

Getting The Hard Money Atlanta To Work

Table of ContentsIndicators on Hard Money Atlanta You Need To KnowHard Money Atlanta - TruthsThe Best Strategy To Use For Hard Money AtlantaGet This Report on Hard Money AtlantaThe Greatest Guide To Hard Money AtlantaSome Known Incorrect Statements About Hard Money Atlanta

If you can not pay back in time, you should re-finance the financing right into a traditional commercial home loan to extend the term. Otherwise, you'll shed the property if you skip on your car loan. Make certain to cover your bases before you take this funding alternative.Intrepid Private Funding Group offers quickly access to difficult money lending institutions as well as is devoted to offering our clients with a personalized service that satisfies as well as surpasses their assumptions for a pain-free funding process. Whether you are interested in new building and construction, residential advancement, turns, rehab, or other, we can assist you get the funds you need quicker than a lot of. hard money atlanta.

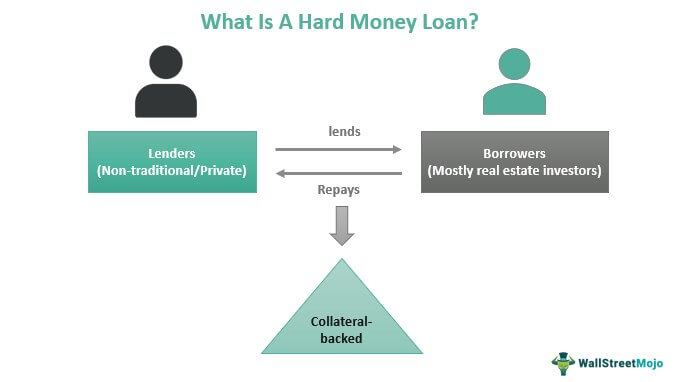

With traditional loans, lenders usually look at the consumer's capacity to repay the car loan by checking out his/her credit report, FICO credit report, debt-to-income ratio, and so on. While some tough cash lending institutions might still take these aspects right into factor to consider, most base candidacy on the value of the residential property. The consumer, as an example, might put a home or home that she or he owns - partially or completely - up for collateral.

Top Guidelines Of Hard Money Atlanta

Let Intrepid Private Capital Team assist you obtain the personal capital that you require for your business or job. That Requirements a Difficult Money Funding? While anyone can obtain a hard cash loan, they are best fit for the following: Residential or commercial property flippers Buyers with bad credit score Buyers with little-to-no credit scores Investor Building programmers What is the Loan-to-Value Ratio When considering a tough money funding, you must pay very close attention to the charges, financing term, as well as most notably, the loan-to-value proportion.

Call United States for Extra Details Do not hesitate to call us with any type of inquiries you have (hard money atlanta). Our pleasant personnel prepares to help you get your task off the ground!.

The Main Principles Of Hard Money Atlanta

Hard cash loaning can be profitable, but as with any company, the opportunities of profitability boost when specific problems are met. Hard money lending is most likely to be successful when: The lender recognizes the property market visit the website in the areas where it operates. The lending institution can successfully identify, finance, take care of, and service car loans.Make sure you understand and adhere to any kind of appropriate policies as well as demands. If you purchase a hard money lending fund, check to guarantee the fund abides by applicable policies and demands. If you determine to come to be a difficult money lending institution, either straight or via a fund, be sure to comprehend the pertinent incomes and costs, both essential motorists of earnings.

Not all hard cash lenders charge all these fees. Hard cash loan providers incur prices, including underwriting car loans, servicing car loans, reporting, marketing to customers and financiers, and all the costs that include running any kind of company, such as spending for office as well as energies.

How Hard Money Atlanta can Save You Time, Stress, and Money.

As tough cash lending institutions in Arizona, we are often asked if we function like conventional banks. We do not. Among the most usual inquiries is "are we a direct lender?" That's constantly an outstanding inquiry, and whether you select to deal with Resources Fund 1 or not, you should ask this to every difficult cash lender you go shopping in Phoenix - hard money atlanta.A true hard cash company has a resource of direct funds, and also no middleman to handle your finance. We service as well as underwrite all of our own fundings, supplying go to my blog funds for your investment acquisition on part of our capitalists.

Following time you look for an exclusive home loan, ask if the broker is a direct loan provider or if he is just the co-broker. Doing so will certainly save you some time and cash in the future. Among the several advantages of loaning from a Personal Difficult Cash Lending Institution, like Capital Fund I, is that we perform all underwriting, paperwork, and also signings internal, therefore we can fund lendings in 24 hr and also also quicker in some instances.

Hard Money Atlanta for Dummies

The collateral is the only thing that is underwritten. Due to this as well as the personal nature of the funds, these sorts of financings are typically able to be funded in very short time frameworks. The major distinctions between Hard Money and also Standard or Institutional Lending are: Higher Rates Of Interest Much Shorter Funding Term Larger Deposit Requirements Quicker Finance Funding Due to the reality that Hard Cash lending institutions don't finance the Consumer their comfort level with the finance comes from equity (or "skin") that the Consumer places in the deal.With this in mind, the Hard Cash lender intends to keep their finance total up to a number at which the home would certainly more than likely sell if it was taken to trustee sale. Private loaning has actually emerged as one of the safest and most trusted kinds of funding for financial investment residence purchases.

As a trustee click here to find out more customer, you don't have a whole lot of time to decide and also you definitely can not wait around for the traditional bank to money your funding. That takes at least one month or even more, and you need to act fast. You may simply decide to utilize cash money available when you go to the trustee auctions.

How Hard Money Atlanta can Save You Time, Stress, and Money.

A tough money financing is an ultramodern, guaranteed funding given by a financier to a buyer of a "difficult possession," generally property, whose creditworthiness is lesser than the worth of the property. Difficult cash finances are extra usual genuine estate investments buying a rental property or turning a house, for instance and also can get you money swiftly.Report this wiki page